Understanding the financial strategies involved in mergers and acquisitions (M&A) is crucial for creating a successful transaction. Properly structured deals can maximize value, improve stakeholder confidence, and enhance competitive positioning. Focus on these proven approaches to successfully navigate the complexities of M&A financial strategies.

Conduct thorough due diligence. Before engaging in any transaction, a careful evaluation of the target company’s financial health, operational performance, and market position is essential. Analyze financial statements, cash flow, and key performance indicators. This provides clarity and uncovers any potential liabilities that may not be immediately apparent. Due diligence helps establish a suitable valuation and informs negotiation tactics.

Valuation remains a cornerstone of successful M&A activity. Use several methods to determine the fair value of the target company. Techniques like discounted cash flow (DCF) analysis, market comparables, and precedent transactions equip you to make well-informed decisions. Customizing valuation methods to fit the unique characteristics of the companies involved enhances the efficacy of your financial assessment.

Creating a financial model aids your understanding of potential scenarios. This model allows you to project revenue streams, costs, and synergies that may arise from the acquisition. A well-structured model helps quantify the financial impact on your existing operations. Also, consider variables like market conditions and future growth to ensure flexibility in your operations moving forward.

Focus on integration planning early in the M&A process. Engage in proactive integration efforts to realize the targeted synergies promptly. Develop a clear strategy that outlines timelines and resource allocations for merging operations, systems, and cultures. Good integration planning enhances value by accelerating achievement of synergies, minimizing disruption, and preventing attrition of key talent.

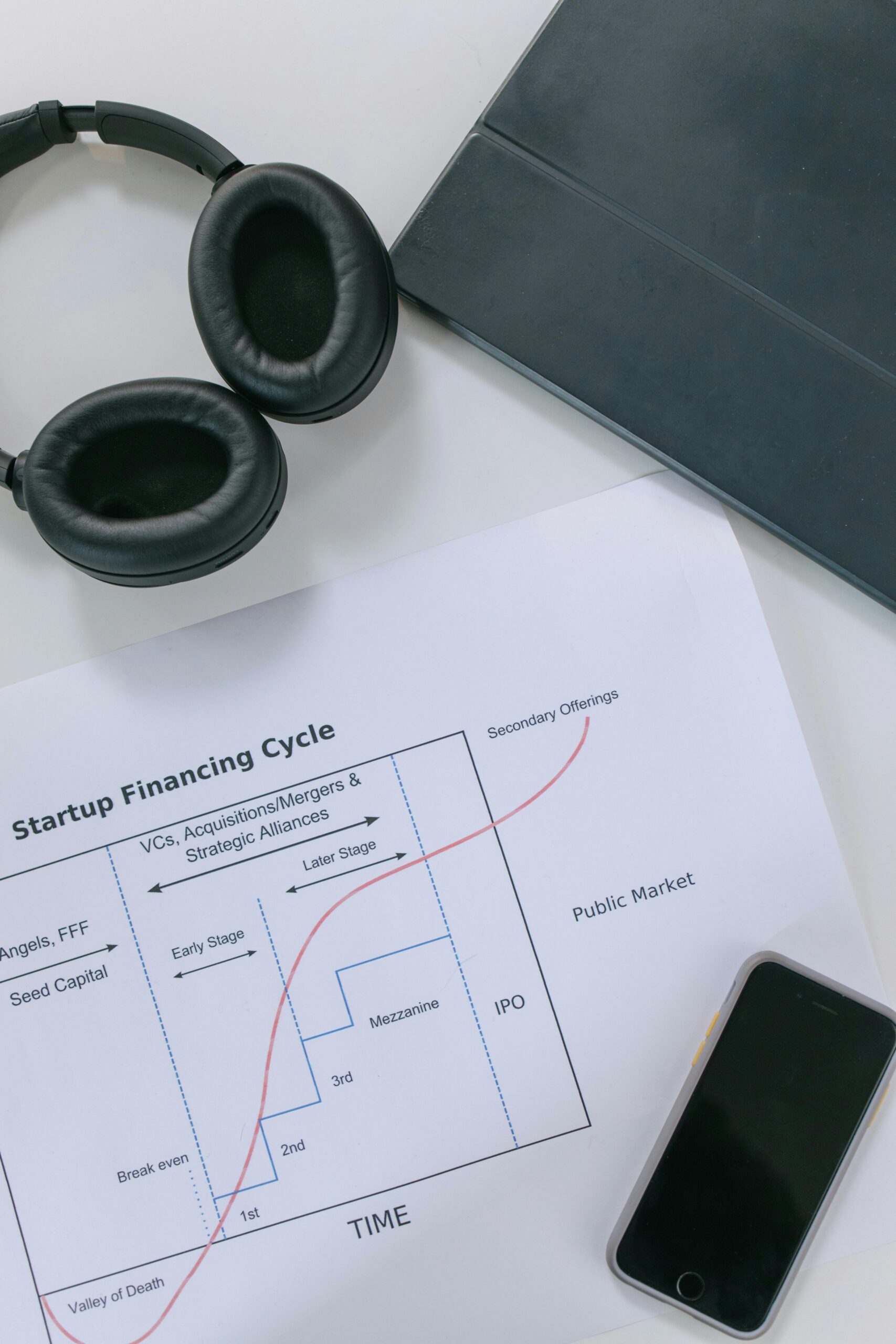

Understanding financing options plays a critical role in M&A transactions. Assess how the acquisition will be financed, whether through cash, debt, equity, or a combination. Each method has distinct implications for your balance sheet, investor relations, and overall capital structure. Choosing the appropriate financing method with careful consideration of the associated risks and returns can significantly shape the financial outcome of the deal.

Communicate effectively with stakeholders. Being transparent enhances trust and engenders buy-in, creating an advantageous environment for negotiations. Convince stakeholders of the value the transaction will bring. Provide detailed change plans to alleviate concerns about risks and uncertainties. A well-informed team can help facilitate smooth execution around the deal.

Develop a clear timeline and milestones that align with your strategic objectives. deadlines ensure accountability and motivate teams to meet goals. Include checkpoints to evaluate progress and adjust for any unforeseen challenges that may occur. Regularly communicate progress to your stakeholders to keep them aligned and engaged throughout the process.

Pay attention to regulatory requirements. Consider antitrust laws, industry regulations, and any required approvals before finalizing deals. Understanding legal implications can prevent transaction delays or sudden setbacks. Engaging seasoned legal and financial experts mitigates risks associated with regulatory compliance, allowing for a streamlined deal process.

Monitor performance post-acquisition. After the deal closes, it’s vital to assess the integration and adjustment phases. Create key performance measures to evaluate the success of the acquisition and measure synergies realized. Continual assessment allows for swift action if the initial projections and outcomes diverge. Quick corrective measures can assist you in achieving anticipated targets.

M&A transactions often result in unexpected challenges. Therefore, employing a robust risk management framework is necessary. Identify potential risks before and after the transaction. Types of risks can include financial instability, operational hiccups, or market shifts. Developing contingency plans enables you to engage proactively rather than reactively whenever issues arise.

Draw lessons from previous M&A experiences. Analyze past transactions to glean insights that will inform future efforts. Every deal offers unique challenges and learning opportunities despite how successful they may be. Embrace a culture of learning within your organization. Sharing learnings from prior experiences sharpens everyone’s ability to make better financial decisions moving forward.

Utilizing technology to enhance efficiency challenges entrenched processes. Invest in advanced analytics tools to streamline due diligence, valuation, and post-merger integration. Leverage automation in routine financial operations wherever applicable. Digital solutions yield efficiency while minimizing errors tied to human input. In turn, offer more accurate perspectives on financial developments throughout the M&A lifecycle.

Establish best practices for corporate governance in post-merger integration efforts. Clear roles and responsibilities prevent confusion and overlap. Strong governance、 compatible internal controls, and oversight ultimately drive effective integration. When governance practices remain cohesive and transparent, maintaining regulatory compliance proves easier, thus strengthening confidence going forward.

By focusing on these proven approaches in M&A financial strategies, you set a solid foundation for successful transactions. Each element complements the others systematically as you navigate complexities. Emphasize meticulous planning, assertive communication, diligent due diligence, and continuous improvement. Ensure that your organization emerges stronger and more competitive in your market.

Applying proven financial strategies in mergers and acquisitions can significantly enhance your negotiation outcomes. Deepen your understanding by accessing our collection of insightful Business articles. Visit our Business articles now for more valuable insights tailored to your financial journey.

image source: Ivan Samkov